Commercial real estate (CRE) stands as a promising investment arena, often favoured for its stability and lucrative prospects. If you’re contemplating entering this domain, our comprehensive guide is tailored to equip you with the essential insights needed to make well-informed investment decisions.

Understanding Commercial Real Estate

At its core, commercial real estate encapsulates properties designed for business purposes. This expansive sector includes diverse property types such as office buildings, retail spaces, industrial warehouses, apartment complexes, and hotels. Investors access CRE either directly by acquiring property or indirectly through vehicles like Real Estate Investment Trusts (REITs).

Reasons to Venture into Commercial Real Estate

The appeal of CRE as an investment avenue lies in its manifold advantages:

High Yield Potential: Historically, CRE has showcased superior returns compared to conventional asset classes like stocks and bonds.

Stability Amidst Volatility: Renowned for its stability, CRE tends to weather market fluctuations more robustly than other investments.

Portfolio Diversification: CRE introduces diversity, enhancing the resilience and balance of investment portfolios.

Tax Advantages: CRE investments offer various tax benefits, serving as a favourable aspect for many investors.

Inflation Hedging: CRE can act as a hedge against inflation, retaining value in the face of economic fluctuations.

Various Avenues for Commercial Real Estate Investment

Diverse options exist for delving into the world of commercial real estate:

Direct Investment: A straightforward approach involves direct acquisition of commercial properties.

REITs: Real Estate Investment Trusts function as entities owning and managing income-generating real estate, providing an indirect route for investors.

Real Estate Crowdfunding: A burgeoning method that pools investments from multiple individuals to fund commercial real estate projects, offering a participative investment experience.

Benefits and Risks in Commercial Real Estate Investment

Benefits:

Rental Income Potential: Generating regular rental income forms a significant aspect of CRE investments.

Asset Appreciation: Properties in CRE often appreciate over time, enhancing overall investment returns.

Diversification: A well-selected CRE portfolio can offer diversification, mitigating risks inherent in other investments.

Inflation Hedge: The value retention feature of CRE often acts as a hedge against inflationary trends.

Risks:

Market Fluctuations: CRE values may fluctuate due to changes in market conditions, impacting overall returns.

Operational and Maintenance Costs: Managing CRE properties incur maintenance and operational expenses that affect profitability.

Economic Vulnerability: Economic downturns can impact demand for commercial spaces, influencing returns on investments.

Navigating the realm of commercial real estate necessitates a comprehensive understanding of its nuances, risks, and potential benefits. Armed with the knowledge garnered from this guide, you’re better equipped to explore and make strategic moves within this promising investment domain.

Understand the Basics

Begin with, familiarise yourself with the fundamentals of commercial real estate investment. Dive into various resources available, from books to online courses, aiding in understanding the nuances, strategies, and market trends shaping CRE investments.

Securing Professional Guidance

Seek out a reputable advisor or mentor in the field. A seasoned advisor not only imparts knowledge but also provides insights into navigating the risks and rewards of the CRE domain. They can assist in pinpointing suitable investment opportunities aligned with your financial goals.

Thorough Due Diligence

Before delving into any commercial property investment, conducting comprehensive due diligence is paramount. This involves meticulous research, analyzing property details, market trends, tenant profiles, and economic prospects. This scrutiny ensures informed decision-making and minimises potential risks.

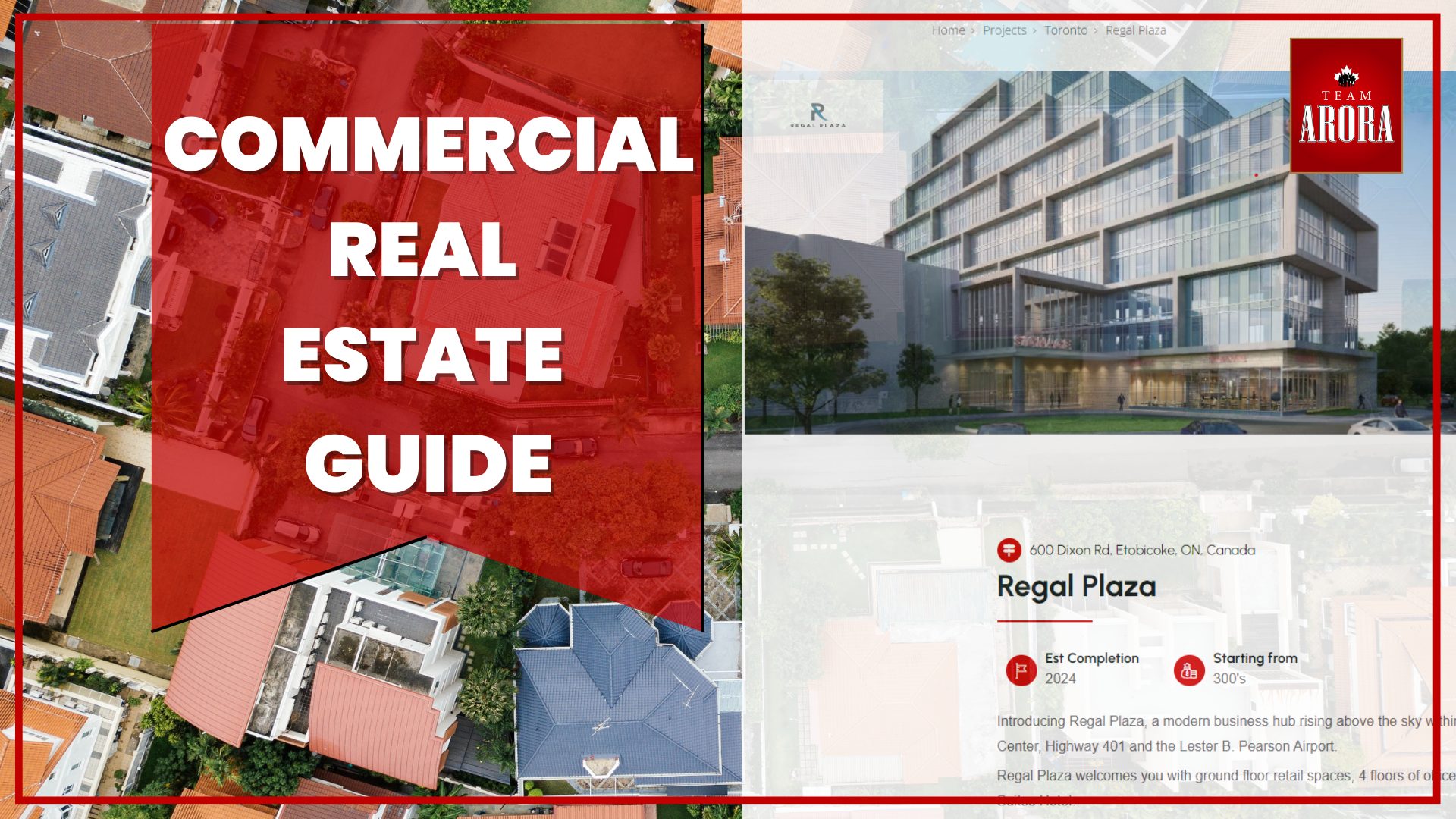

Case Study: Regal Plaza, Etobicoke, ON

An exemplary case in point is the Regal Plaza situated in Etobicoke, Ontario. This contemporary commercial establishment boasts ground-level retail spaces, four floors dedicated to office spaces, and an additional seven floors hosting the Staybridge Suites Hotel. Its strategic proximity to major transportation arteries like Highway 401 and Toronto Pearson International Airport, coupled with its adjacency to the Toronto Congress Centre, positions Regal Plaza as a prime investment opportunity.

CRE Investment: A Wise Choice for Astute Investors

Investing in commercial real estate presents an astute move for savvy investors aiming to diversify their portfolios and seek potential high returns. Armed with the insights gleaned from this holistic guide, your prospects for success in the commercial real estate landscape soar.

FAQs on Commercial Real Estate Investment

Q: What distinguishes commercial real estate from residential real estate?

A: Commercial real estate refers to properties utilized for business purposes, while residential real estate pertains to properties designated for living.

Q: How can I mitigate risks associated with commercial real estate investment?

A: Diversifying investments, conducting meticulous due diligence, and partnering with a reputable advisor can mitigate these risks.

Q: What tax benefits come with investing in commercial real estate?

A: Tax advantages encompass depreciation deductions and potential deferral of capital gains taxes, amongst others.

Q: Is commercial real estate a viable investment for me?

A: The viability of CRE investment hinges on individual circumstances and risk tolerance. However, for those who comprehend market trends, it can indeed be a judicious choice.